Sustainability disclosure standards and regulations, including climate disclosures, are evolving rapidly as regional jurisdictions move to align with recently released global standards. In the series Making sense of sustainability and climate disclosures…what really matters? we explore what the changes might mean for your organization. Part 1 - ESG materiality: What really matters explores the topic of Materiality.

Download the article for later or continue reading below.

The momentum behind addressing Environmental, Social and Governance (ESG) matters as an integral part of business management is growing, but the road ahead remains complex.

The world of ESG disclosures and standards is evolving rapidly, and reporting expectations are moving from “discussion and commitment” to “implementation and evidence”. There’s a global move to align capital markets with sustainability goals through standards and regulation, including in Australia, the European Union and United States.

Effective management of ESG centers on “materiality”. What does this mean and does your organization need to change the way it identifies and addresses material ESG factors?

To unpack these questions, let’s first take a step back...

What are ESG factors and why are they important?

ESG factors or topics are environmental, social and governance matters that your organization could impact (such as a community or ecosystem near your place of operation), may have a dependency on (such as a natural resource or raw material), and that may pose risks and opportunities to your organization (such as climate change or cyber security). They are increasingly used by stakeholders, especially market leading investors and analysts, to holistically assess an organization’s operations and screen potential investments.

Identifying and managing material ESG factors for your organization or project strongly influences performance and resilience of developments and investments over time and enhances risk management.1 From a standards and regulations perspective, it is also the initial step that determines what companies must make public disclosures about.

ESG factors encompass:

-

Environmental

An organization’s commitment to environmental matters such as greenhouse gas emissions (GHG), energy management and water management.

-

Social

An organization’s relationship and reputation with stakeholders and communities including human rights, social value and equity, equal pay, labor relations and diversity and inclusion.

-

Governance

An organization’s internal system of practices, controls and procedures for governance, ethics, compliance, audits, internal controls and shareholder rights.

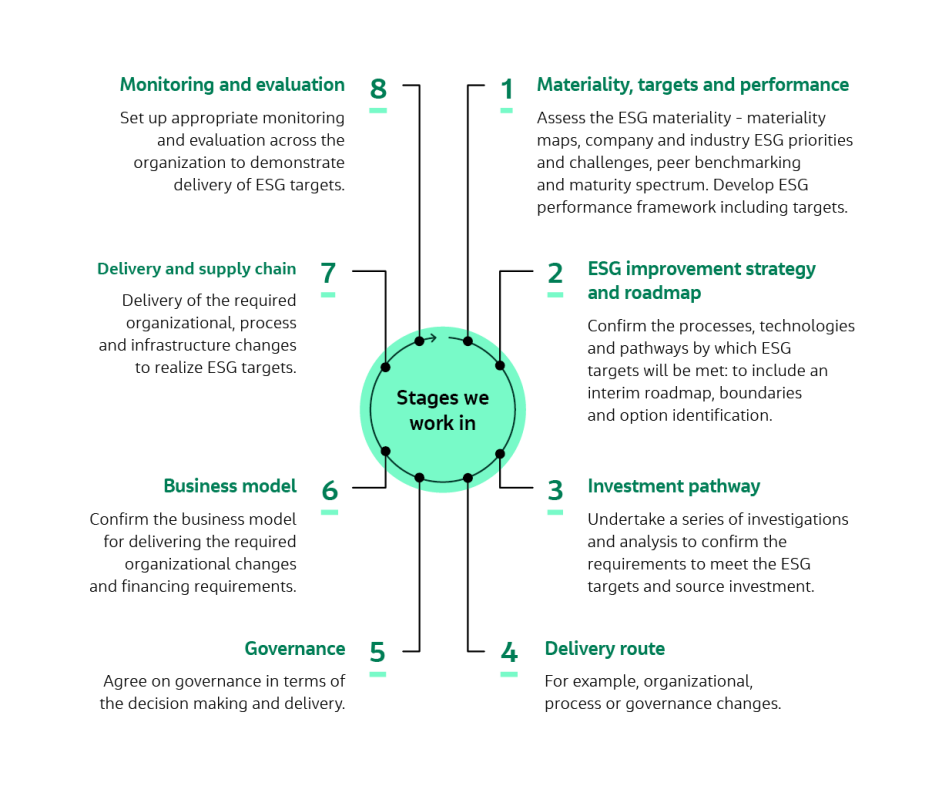

Organizations benefit from clearly defined goals and aspirations as part of an integrated ESG framework (see Figure 1 below). We use a framework that demonstrates a holistic approach to sustainable development, design and operation at both an organizational and project level. Identifying your material ESG factors is the first step.

Figure 1: Integrated ESG Framework

What are “material” ESG factors?

Material ESG factors are the factors most critical to your organization. They directly inform what is reported and managed. Historically “material” factors have been assessed on their impact on enterprise value or financial materiality.

Standards and frameworks have varying definitions of materiality to guide the identification of factors and material information; for example, the International Financial Reporting Standards (IFRS) Foundation’s International Accounting Standards note that “information is material if omitting, misstating or obscuring it could reasonably be expected to influence the decisions that the primary users of general purpose financial statements make on the basis of those financial statements, which provide financial information about a specific reporting entity.”2

While the International Sustainability Standards Board (ISSB) Sustainability Disclosure Standards use the same definition of material as IFRS Accounting Standards, we’re starting to see “double materiality” approaches emerge through frameworks and initiatives, including the EU’s European Sustainability Reporting Standards as a regulated approach to identifying material information.

Double materiality encompasses financial materiality and impact materiality.

Impact materiality looks at your organization’s impact on the world (society and the environment) either directly through your operations, or indirectly in your value chain. This double materiality concept reflects that ESG impacts, dependencies, risks and opportunities can be material to an organization from either an impact perspective, a financial perspective or both.

Exposure to different ESG factors and the subsequent impacts, dependencies, risks and opportunities they pose depends on the type of business your organization is engaged in. For example, if your organization operates in an industry highly or moderately dependent on nature as a resource or is a service provider somewhere across the supply chain, such as forestry and agriculture, electricity, construction, water utilities and mining, your exposure to certain environmental risks and opportunities would likely be greater compared to organizations in sectors such as financial services or communications.3

How do you identify material factors?

Material factors are highly influenced by an organization’s purpose, mission and strategy, the nature of its business, relevant regulatory requirements, sustainability drivers, stakeholder and customer expectations, industry issues and societal expectations. If undertaking a double materiality assessment, you are considering material factors through the two lenses: their impact on your organization and their impact on society and the environment.

To define and understand which factors are material to your organization, you need to understand the breadth and composition of your operations and value chain (including the stakeholders with whom you work, serve and support), identify your ESG-related factors, then identify impacts, dependencies, risks and opportunities associated with those factors, and perform a materiality assessment. This includes engaging with relevant internal and external stakeholders to understand actual and potential impacts and their significance.

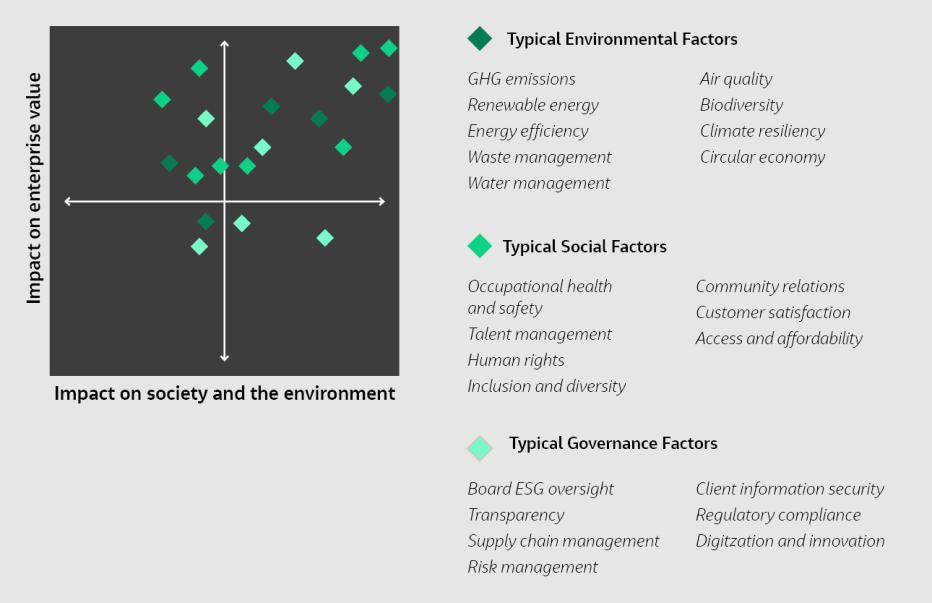

We use tools and techniques including targeted stakeholder workshops and interviews with internal and/or external participants, peer benchmarking and research, and decision analysis tools to undertake materiality assessments and prioritize ESG factors. Your identified material factors should then be communicated to your key stakeholders through things such as your annual report or annual sustainability report. While many ESG standards and frameworks recommend or require the use of a materiality matrix to identify and disclose material ESG factors (Figure 2 below), we are increasingly seeing material factors visualized as a list or table (Table 1 below).

Figure 2: Example Matrix of Material Factors

Table 1: Example List of Material Factors

Who should be involved in the materiality assessment process?

To understand and evaluate ESG factors in full, all key stakeholders should be involved in the assessment process. Start by mapping out your key internal and external stakeholders and then consider their level of interest, influence and impact of your organization.

By involving key stakeholders in the materiality assessment process, organizations can build trust and break down departmental silos to build cross-functional teams, collaborating to create long-term value while enhancing rigor, robustness and credibility of the assessment itself. This may look like engaging your external stakeholders through surveys or interviews and running more in-depth workshops with your internal stakeholders, or vice versa if your assessment is best informed by external parties.

-

Internal Stakeholders

- Board of Directors

- Executive leadership

- Functional and operational heads

- Supply chain leads

- Communications

- Legal, ethics and compliance advisors

- Human resources

- Employee representatives

-

External Stakeholders

- Customers

- Commercial partners

- Community groups

- Investors

- Non-government organizations

- Suppliers

- Trade associations

- Commercial real estate providers

Case Example – Government Road Department

Jacobs recently supported a major Australian state government road department to identify, understand and map the material ESG factors for a new project.

Drawing on its existing strategy, targets and reporting, we engaged internal and external stakeholders relevant to the project and condensed our findings into key factors that would inform and influence the project and the organization. The organization gained key insights, including the importance of local employment outcomes for First Nations communities and sustainable procurement to the project and the organization.

What are the benefits of undertaking or refreshing your ESG materiality assessment?

Whether you’re starting out on your journey to identify the material ESG factors for your organization or reviewing them in light of changing regulations and stakeholder expectations, undertaking or refreshing your materiality assessment and integrating material impacts, dependencies, risks and opportunities into your organizational strategy will mitigate key risks, including:

- Regulatory non-compliance / greenwashing claims.

- Loss of reputation / social license to operate.

- Loss of investment capital.

It will also likely realize the following benefits:

- Enhance your management of key impacts, risks and opportunities to improve ESG outcomes for your organization, people and planet, and to build business resilience.

- Update your organizational strategy to ensure all material impacts, dependencies, risks and opportunities are being managed.

- Inform stakeholder communications and provide a solid foundation for dialogue with external stakeholders.

- Enhance internal stakeholder engagement to build cross-functional teams with shared accountability for holistic, informed operational decision-making and corporate governance.

- Align with emerging regulatory reporting requirements.

- Gain government support and access to funding.

- Attract risk-savvy and sustainability-driven investors and enhance investment returns.

- Increase customer satisfaction.

- Realize cascading value to the environment and society through the organization’s value chain.

- Drive brand value and consumer preference through transparency and visible accountability.

Want to talk?

Jacobs is ready to support your organization’s ESG ambitions and management needs, no matter where you are in the process or where you’re located in the world. Find out more about our ESG consulting services, or get in touch with our team below.

Keep an eye out for the next article in this series: Why ESG data and information matters (and is currently lacking)

You might also enjoy:

-

Podcasts

PodcastsFrom Ambition to Action: Bridging the Gap with Sustainability

In a world where climate change and ESG are becoming increasingly popular buzzwords and themes for Big Business, how can we ensure that companies truly "walk the talk" on sustainability by taking actions that deliver tangible, impactful results? On this episode of If/When, this question is tackled by Global Solutions Director of Sustainability, Resilience & Climate Response for the Americas Region at Jacobs, Hollie Schmidt, who shares what she's learned in her career around helping organizations move the needle on sustainability and how to avoid pitfalls in their efforts.

-

News

NewsEnvironment Analyst Ranks Jacobs as the No. 2 Environmental Consultancy in the UK, No. 2 Globally

In its annual U.K. Market Assessment of the Environmental Consulting Sector, the Environment Analyst reports on the leading 30 Environmental Consulting practices.

References

- Boffo, R. and Patalano, R. (2020). ESG Investing: Practices, Progress and Challenges. Accessed from OECD website: https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf

- IFRS. (2018). Amendment issued: IASB clarifies its definition of ‘material’. Accessed from IFRS website: https://www.ifrs.org/news-and-events/news/2018/10/iasb-clarifies-its-definition-of-material/

- World Economic Forum & PwC. (2020). Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy. Accessed from WEF website: https://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf