Public Private Partnerships (PPPs) — also known as P3s or Private Finance Initiatives (PFIs) — are long-term contracts between governments and private entities to finance, design, construct, operate and maintain facilities or services traditionally provided by the public sector. Often lasting 25-30 years, PPPs are commonly used to deliver infrastructure projects while sharing risks and rewards between both sectors.

While the basic structure of PPPs can apply to many projects, key elements differ depending on the type of deal at hand. This article explores elements of PPPs specifically designed to address operations and maintenance of existing roads and highways. It also shares insights and recommendations for optimizing these agreements to boost infrastructure quality and performance.

Why brownfield highway projects matter

Brownfield projects focus on upgrading or expanding existing roads and highways. These projects are essential to extending the life of aging infrastructure, improving safety, traffic flow and/or user experience. PPPs often play a crucial role in delivering these projects and raising the quality of service for road users.

The core goal of O&M activities in brownfield projects is to preserve existing road infrastructure over the long term. A correctly structured O&M PPP agreement transfers day-to-day management, operations and maintenance responsibilities to the private sector with clearly specified performance metrics. This shift allows for more efficient delivery, introduces private financing, and reduces upfront public investment. Risk is shared between sectors based on the agreement’s structure.

Balancing risks and rewards

When defining the payment mechanism to the private sector in a brownfield road PPP, the government needs to consider who retains two key risks, which are:

- Traffic risk: If actual usage (vehicle counts, passenger numbers) differs from forecasts this may impact revenue (if the road is tolled or shadow-tolled) and O&M costs (higher traffic leads to more wear and tear).

- Revenue risk: Revenue per vehicle (for a tolled or shadow-tolled road) may be less than expected due to pricing issues, payment collection mechanism, regulatory changes and operational challenges.

In this sense, there are four common payment mechanisms for road PPP projects based on the allocation of these traffic and revenue risks, as follows:

- Real tolls: Users pay directly to use the road. Traffic and revenue risks shift to the private party.

- Shadow tolls: Governments pay the private party based on traffic metrics, with the users not having to pay directly for the road usage. Traffic and revenue risk is shared between both parties.

- Availability payments: Governments pay the private party for meeting performance and quality standards. Traffic and revenue risk is largely retained by the government (with the private sector only being subject to the impact of higher/lower traffic on maintenance costs).

- Revenue sharing: Often used in tolled projects, lower-than-expected and higher-than-expected revenues are shared between parties. Traffic and revenue risks are shared between parties.

Each approach aligns incentives to encourage efficiency and maintain infrastructure quality.

Case studies: Brownfield PPPs around the world

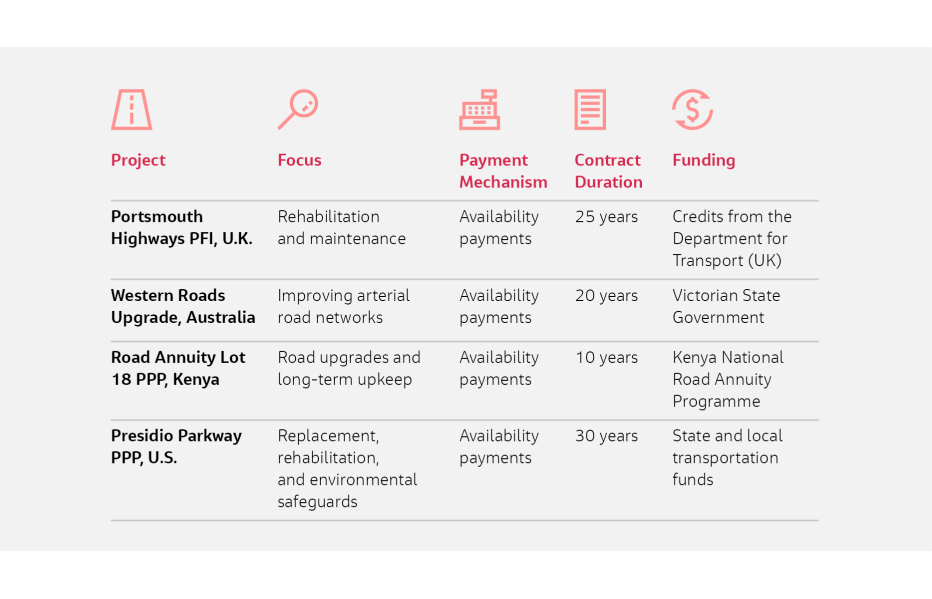

We analyzed four global brownfield highway PPP case studies, focusing on the O&M aspects, contract structure and funding. While there is a range of payment mechanisms, the most common was the Availability Payment Model.

Our analysis highlights several important trends, including:

- Long-term contracts (10-30 years) provide stability for maintenance and operations, ensuring infrastructure longevity and efficient resource allocation.

- Performance-linked payments incentivize high-quality outputs that meet contractual standards.

- Focus on risk management fosters accountability between public and private partners.

- Prioritizing sustainability and efficiency helps extend asset lifespan and improve infrastructure networks for future use.

Best practices for future projects

To optimize brownfield roads and highways O&M PPPs, we recommend:

- Adopting Long-Term Contracts: Contracts spanning 10 to 30 years provide a stable environment for consistent, high-quality maintenance. They enable governments and private partners to plan better, allocate resources efficiently and maintain infrastructure to high standards long term.

- Using Performance-Based Payment Mechanisms: Payments linked to performance metrics and milestones promote accountability and incentivize private partners to deliver high-quality results. This approach helps maintain infrastructure standards and aligns payments with measurable outcomes.

- Exploring Innovative Payment Mechanisms: Tools like congestion charging, development rights near project sites, Land Value Capture and Tax Increment Financing (TIF) can unlock new revenue streams and reduce the burden on public funds.

The Presidio Parkway PPP uses an innovative payment mechanism where the private party can implement tolling to generate revenue, which can offset availability payments and share a portion with the government. Such innovative mechanisms can enhance the financial viability of projects and provide additional revenue streams.

- Including Capital Expenditure: Significant investments in rehabilitating, expanding or upgrading infrastructure are essential for enhanced safety, functionality and capacity while a PPP model helps deliver these with much lower upfront costs for the public sector. These capital expenditures are central to achieving long-term infrastructure improvements and meeting user needs.

The road ahead

PPPs are a powerful framework for addressing the growing need to maintain and modernize existing road and highway infrastructure. With the right funding, structure and risk-sharing approaches, brownfield road and highway PPPs can deliver lasting value to governments and private entities, and enhance road quality and safety for communities worldwide.

Meet the authors

Jean-Pierre Labuschange

Jacobs Director of Transaction Advisory at Strategic Advisory – Middle East

JeanPierre.Labuschagne@jacobs.com

Jean-Pierre is the director of transaction advisory at strategic advisory – Middle East. Specializing in social and economic infrastructure advisory and Public-Private Partnerships, his experience spans rail, bridges, roads, healthcare, solid waste, sanitation, water and accommodation projects.

Rana Hamed

Jacobs Principal Consultant

Rana.Hamed@jacobs.com

Rana is a principal consultant with more than nine years' international experience in large-scale infrastructure projects and programs. She has a proven track record in guiding economic strategies and conducting comprehensive financial and economic due diligence of mega infrastructure projects.